Quarterly results

Amundi - Paris

5 March, 2026 - 15:55 (CET) Central European Summer TimeOur Group

As Europe's leading asset manager among the world's top 10 players, we offers its 100m clients - individuals, institutions and corporates - a full range of savings and investment solutions in active and passive management, in traditional and real assets. This offer is enriched with services and technological tools that cover the entire savings value chain. A subsidiary of the Crédit Agricole group, Amundi is listed on the stock exchange.Governance

Our Ambitions Strategic Plan

Shareholding

General Meetings

Ratings and debt issuance

01

Governance

Governance

Find out more about our various governance bodies such as the Board of Directors, the Management Committee, the various committees and the associated documents.

02

Our Ambitions Strategic Plan

Our 2025-2028 strategic plan

“Invest for the future”, our plan prioritises growth, diversification, innovation, efficiency, and selective investments to deliver attractive value for shareholders and excellence for clients.

03

Shareholding

Shareholding

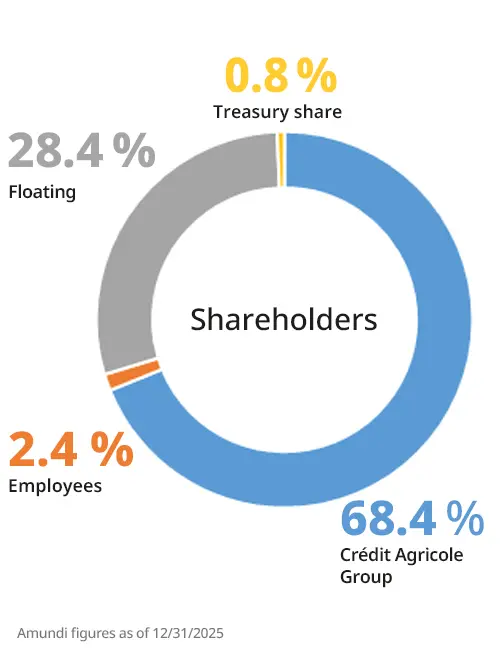

Amundi data as of 31/12/2025:

- Crédit Agricole Group: 68.4%

- Free float: 28.4%

- Employees: 2.4%

- Self-ownership: 0.8%

Market capitalization as of 31/12/2025: €14.6bn

04

General Meetings

General Meetings

Our 2025 Ordinary and Extraordinary General Meeting was held on 27 May 2025 at 2.30 p.m. at 54 rue de Varenne, 75007 Paris.

05

Ratings and debt issuance

Ratings and debt issuance

As part ofour international development, we obtained our rating from Fitch in 2015.

Fitch chose to assign the senior long-term debt rating A+ to the entire Amundi group.

In 2024, Fitch Ratings renewed its long-term A+ rating for Amundi for the ninth time. This rating confirms the validity of our business model and financial solidity.

First European asset manager

Assets under management at a new record high at 31/12/2025

+€1,858mAdjusted pre-tax income¹, up +6%² over the year

+€88bnRecord annual net inflows, Positive inflows in both passive management and active management

€4.25Dividend proposed to the General Shareholders’ Meeting of €4.25 per share

New 2025-2028 strategic plan

Press releases

Regulated Information

Your contacts

- Amundi has chosen to present adjusted accounting data for certain income items (net revenues. general operating expenses. share of net income of associates) in order to better reflect the economic and operating profitability of the company. These adjustments are intended to neutralise the impacts identified during acquisitions.

- Pro forma: in this document, the historical series have been restated on a comparable basis.

- Assets under management and net inflows including assets under advisory and marketed and funds of funds. including 100% of assets under management and net inflows from Asian JVs; for Wafa Gestion in Morocco and the distribution to US clients of Victory Capital. the assets under management and net inflows are included in Amundi's share in the capital of both entities.