As Chinese financial institutions and investors increasingly embrace diversification, our global analysis on multi-asset allocation, as well as systematic and pragmatic investment solutions have attracted significant attention to the local market.

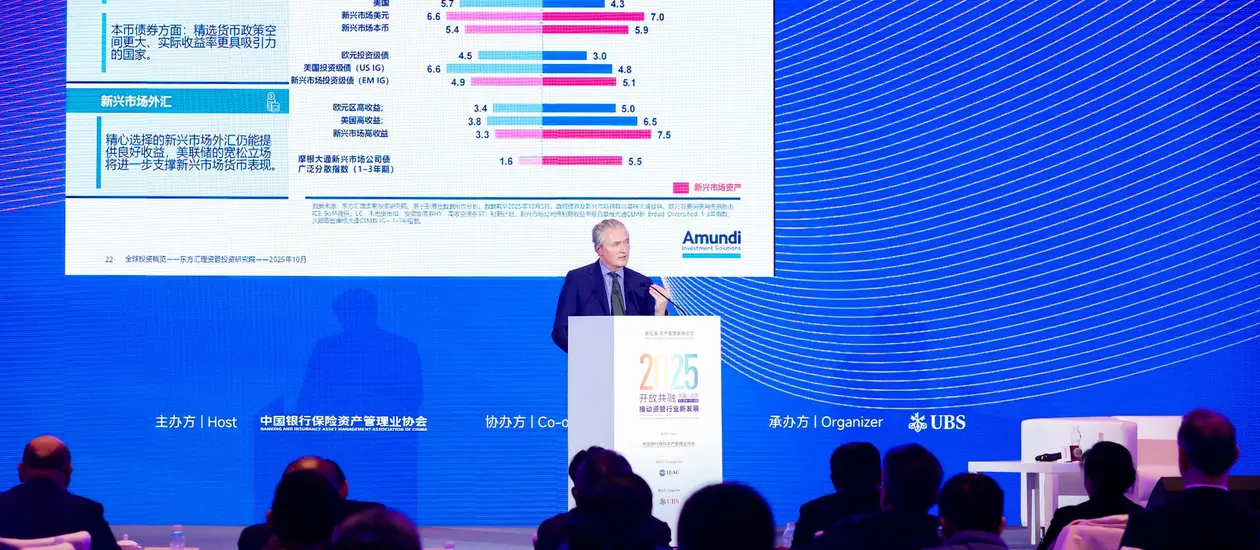

Recently, in parallel with the growing debate on multi-asset allocation in the local market, we were invited by China Wealth Management 50 and the Banking and Insurance Asset Management Association of China to decode global trends and solutions in multi-asset allocation, at the Global Asset Management Forum 2025 in Shanghai and the IAMAC Asset Management Development Forum 2025 in Beijing.

John O'Toole, Global Head of Multi-Asset Solutions, as Amundi's representative, presented the following key topics discussed in a dialogue with policymakers and professionals from the banking, wealth management and insurance sectors, as well as with asset management peers in China:

- The positive environment for investors, especially with stock market rises, gold price movements and the benefits of 30-year government bond yields;

- The macroeconomic outlook for the remainder of 2025, with the impact of tariffs and high political uncertainty;

- Investment convictions, particularly in asset classes such as fixed income, equities and emerging markets.

- In a complex market environment marked by an economic slowdown and inflationary pressures, with high valuations of risk assets, market volatility can provide opportunities to selectively add risk into stable, quality segments.

- Three interconnected trends require immediate attention globally and in Asia: digitalization, pension redesign for Defined Benefit, transition to defined contributions, and ETF-based solutions.

As Chairman of the International Expert and Advisory Committee of the Banking and Insurance Asset Management Association of China (formerly the Insurance Asset Management Association of China), we have provided in-depth analysis that has charted future directions, gaining recognition not only from associations and the media, but also from local financial institutions. This has unlocked considerable potential for increased collaboration in the mainland Chinese market.