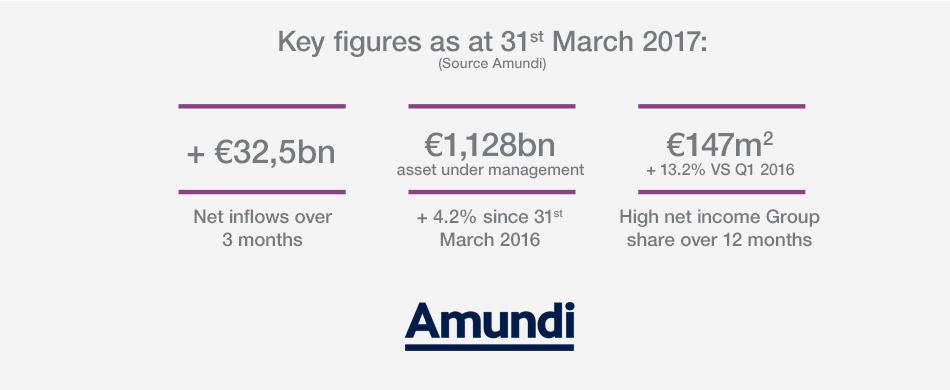

This Friday April, 28th, Amundi publishes strong results in the first quarter of 2017 demonstrating its capacity to generate profitable growth on a recurrent basis.

Amundi’s assets under management amounted to €1,128bn at 31 March 20171, reflecting good business activity (net inflows of +€32.5bn in the first quarter 2017) and a positive market effect (+€12.5bn) owing to more favourable market conditions.