Since the creation of the group in 2010, ESG has been at the heart of Amundi’s growth story. Responsible investment was one of our four founding pillars and remains the cornerstone of our development, as demonstrated again by our recently unveiled 2025 ESG Ambition Plan.

As a responsible asset manager, our role is to deliver long-term sustainable value for our clients and all our stakeholders, by taking into account the major challenges our world and society are facing. We are convinced that the private sector must integrate environmental, societal and governance factors in its analysis and decisions for three main reasons:

- Economic and financial actors carry a strong responsibility towards society

- The integration of ESG in investment decisions is a driver of long term financial performance

- The acceleration of our ESG ambition is the first lever of growth for Amundi globally

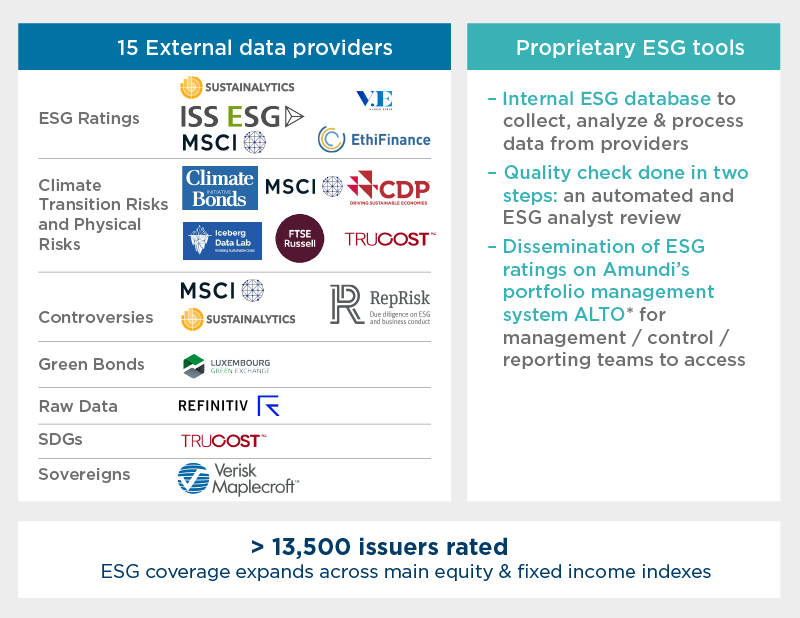

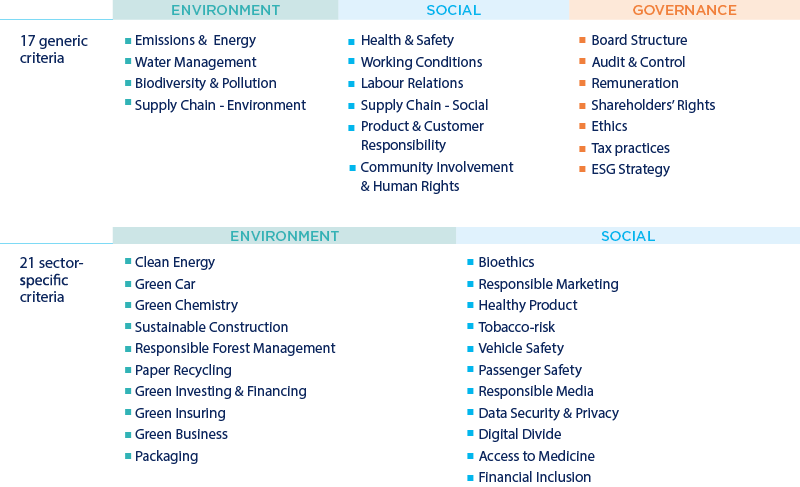

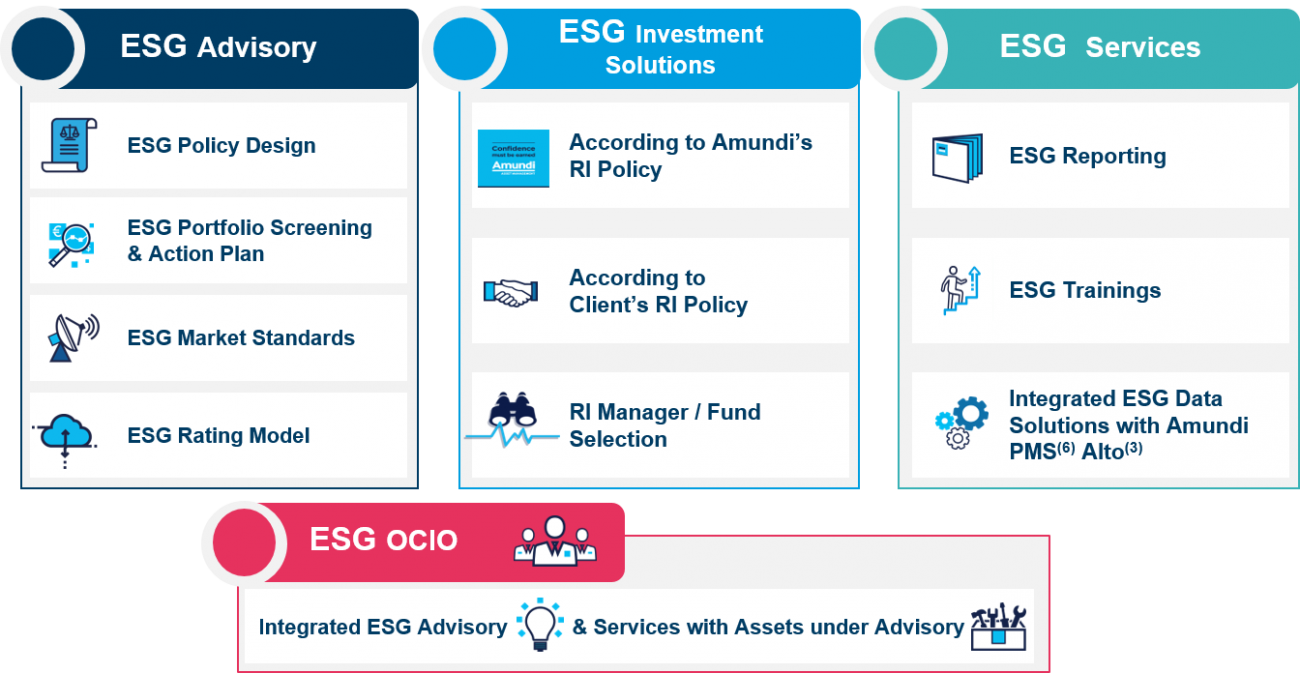

This commitment is reflected both in our responsible investment process (ESG analysis, ESG integration, exclusion policy, engagement and voting) and in the solutions range Amundi has developed, helping clients define and implement their own approach to responsible investment.