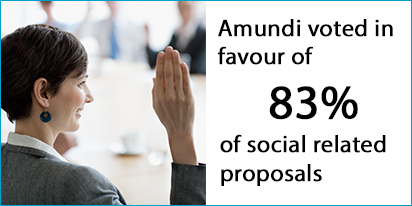

Growing inequalities are one of today’s major challenge. In addition to being a societal major issue, inequalities fuel social divisions and foster political and financial market instability. For all those reasons, this topic is high on our shareholder engagement’s priorities. The COVID-19 pandemic has exacerbated socioeconomic inequalities and has demonstrated that the energy transition will need to be a fair and inclusive transition, taking into account the consequence on the more fragile. While finding solutions to global challenges is primarily the role of governments, we believe that the private sector has a key role to play, especially the financial community. Amundi is convinced that companies must contribute to the social cohesion of the countries in which they operate. We therefore engage with companies to understand how they develop practices that address social challenges.