Savings solutions tailored to your personal goals projects (education, property, retirement...), risk profile and investment horizon, through your usual advisors.

Our clients

100 million clients – retail, institutional and corporates

Individual investors

Benoît Tassou, Head of the French Partner Networks Division

"We are pursuing a twofold objective with our partners: help them accelerate their digital trajectory with our technological solutions and adapt our savings offering to the context and to our clients’ expectations, for example with solutions combining capital guarantees and performance at maturity. In Employee Savings and Retirement, we remained the market leader in France in 2023, with a market share of over 46%,1 6 million individual accounts and 14% growth in assets under management2

Cinzia Tagliabue, Head of the International Partner Networks Division

“Against a backdrop of uncertain markets, our savings clients remained cautious and were particularly receptive to our Buy & Watch investment solutions in 2023. These fixed-term bond funds have the distinctive feature of offering a high, predictable return with a moderate level of risk. Our close links with our international partner networks will enable us to anticipate the changing needs of our clients around the world.”

Savings and wealth managers

The best financial services and innovative technology solutions across the entire savings value chain for:

- retail banks

- private banks

- independent financial advisors

- family offices

- asset managers

- online banks and digital platforms

Fannie Wurtz, Head of the Distribution and Wealth Division, Passive business line

“Our distributor and private banking clients know that they can count on Amundi to help them meet their major transformation challenges. Whether it’s redefining their investment solutions, optimising their open architecture, accelerating their energy transition or transforming their infrastructure and technological tools, we have all the capabilities to offer them tailor-made support.”

Institutional investors

Customised investment solutions to seize opportunities in a regulated environment for:

- insurers

- corporates (including employee savings and retirement solutions)

- pension funds

- central banks

- sovereign wealth funds

Jean-Jacques Barbéris, Head of the Institutional and Corporate Clients Division and ESG

“Thanks to the creation of a Bank Solutions team dedicated to banks and financial institutions for their proprietary trading activities, we can offer this demanding clientele a range of innovative investment solutions that comply with its specific regulatory framework.”

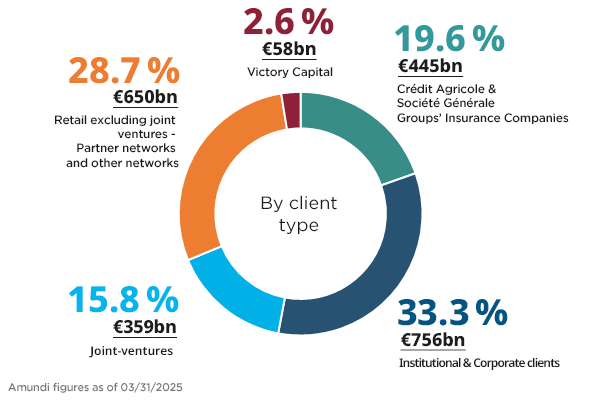

Breakdown of AuM as of 06/30/2025

1 Source: French asset management association (AFG), December 2023.

2 Change in assets under management between December 2022 and December 2023.

To learn more