Our solutions

relying on the input of 900 experts

Research

INVESTMENT INSTITUTE: 11 specialised teams comprising over 60 experts delivering world-class research and advice

FINANCIAL ANALYSIS: 190 economists and analysts in major financial centres

EXTRA-FINANCIAL ANALYSIS: 40 ESG and corporate governance analysts

Investment

ACTIVE MANAGEMENT SOLUTIONS

- Equity

- Fixed income

- Multi-asset

- Liquidity solutions

PASSIVE MANAGEMENT SOLUTIONS

- ETFs

- Equity and bond index management

- Smart beta and factor investing

ALTERNATIVE ASSETS SOLUTIONS

- Real estate

- Private debt

- Private equity

- Infrastructure

- Hedge funds

STRUCTURED SOLUTIONS

- CPPI

- Formula funds

- Strategy funds

- Structured notes

- Employee stock ownership funds

An integrated risk management process securing the delivery of our client promise.

Vincent Mortier, Chief Investment Officer

“With over 1,000 billion euros in assets under management, Amundi is the European leader in Fixed Income and Credit Management. Our platform has the size, teams and tools to develop solutions tailored to the requirements of each of our clients, whatever the market environment. Like our other investment platforms, it offers a wide range of high-performing and competitively priced solutions, thanks to powerful and efficient tools such as ALTO(1), our portfolio management system.”

Dominique Carrel-Billiard, Head of Real Assets and Alternatives

“With the acquisition of Alpha Associates, we will be able to step up our development in the fast-growing private assets multi-management market and to extend our client and geographic coverage. By becoming a European leader in this market segment, we will be able to meet the diversification needs of Institutional investors. We will also be developing new real asset investment solutions tailored to the needs of Retail clients.”

TECHNOLOGY & SERVICES

TECHNOLOGY

- Data management

- Portfolio management systems

- Wealth and distribution platforms

- Dealing services

- Robo-advisors

SERVICES

- Open architecture solutions, including fund selection

- Fund distribution services

- OCIO wealth and institutional solutions

- Operational services

- Training programmes

Guillaume Lesage, Chief Operating Officer

“As an asset manager, we are increasingly placing technology at the heart of our value proposition. We have been using artificial intelligence in our ALTO platform for several years to improve the client experience and automate a number of internal tasks. AI is systematically combined with human expertise and used ethically and responsibly in a dedicated secure environment, enabling us to protect the confidentiality of client data.”

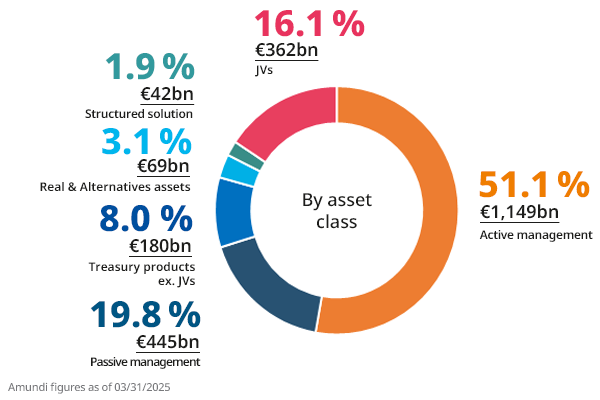

Breakdown of AuM as of 03/31/2025

1. Amundi Leading Technologies & Operations

Learn more...