First nine months of 2019

Net inflows5 for the first nine months of the year totaled +€31bn6, on the back of a very strong third quarter.

Activity was fairly evenly distributed between the different segments:

- Both the Retail (+€14.2bn6) and Institutional (+€16.7bn) segments had increasing flows, and the Institutional segment was primarily driven by MLT assets (+€27bn6).

- From a geographical standpoint, flows were well balanced between France (+€17.3bn) and International markets (+€13.7bn6).

Third quarter of 2019

Total net flows for the third quarter of 2019 were well oriented (+€42.7bn7). Indeed, in a European asset management sector where inflows are gradually improving8, Amundi recorded the best quarterly inflows since its creation, with:

- Solid high net inflows in MLT assets, at +€25.3bn7

- A significant improvement of Retail flows (+€17.8bn7), especially driven by JVs (+€14bn7) and third party distributors (+€4bn),

- Treasury Products recording net inflows again (+€17.4bn).

Moreover, passive management, ETFs, and smart beta had another quarter of strong growth with +€4.3bn9 in net inflows, bringing AuM to €122bn9 at end-September 2019.

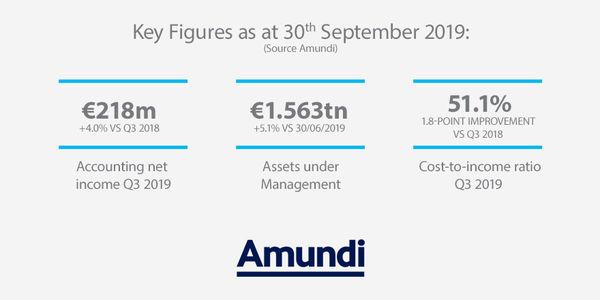

Thus, Amundi’s assets under management5 totalled €1,563m as of 30 September 2019, a +5.1% increase compared to the end of June 2019, and a +9.7% rise from the end of December 2018, thanks to a recovery in inflows and a positive market effect.