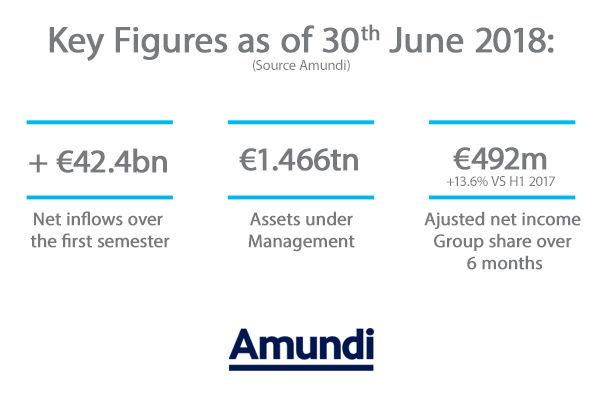

The first half of 2018 closed on a high level of business activity, bringing assets1 under management to €1.466tn, with adjusted net income up sharply (+13.6%2), higher than the announced targets .

Net inflows of €42.4bn3

These high net inflows1 are mainly driven by Retail, MLT (Medium-Long Term) assets, and International.

The Retail segment enjoyed strong momentum, with net inflows of +€34.6bn (versus +€22.2bn in H1 20172), generated by all distribution channels:

- Good commercial performance by the French networks (+€3.2bn2) continued.

- In the international networks, flows remained brisk at +€5.0bn2, illustrating the success of the partnership with UniCredit.

- Inflows for third-party distributors were +€3.0 bn2, driven by France and Asia.

- Flows were strong once again in the Asian joint ventures (+€23.5bn2), primarily in China.

Business activity in the Institutional segment was strong at +€7.8bn in H1 2018 (compared with +€4.1bn in H1 20172), with robust commercial activity for Sovereign and other Institutional clients. Conversely, the Corporates and Corporate Savings segment (-€10.7bn2) felt the seasonal effect of treasury products.

Net inflows by asset class consisted primarily of MLT assets (+€36.5bn or 86% of the total). In addition, the standouts among the commercial successes of this first half (excluding JVs) were:

- Continued market share gains in ETFs bringing passive management and smart beta assets under management to €97bn at 30 June 2018, i.e. +21% over 12 months.

- Steady growth in real assets with net inflows of +€1.3bn in H1 2018 for Amundi Real Estate and a ramping-up of Private Debt (+€1.1bn in net inflows in H1 2018).

From a geographic viewpoint, net inflows were once again driven by the international segment with a significant contribution from Asia (+€30.1bn) and Italy (+€6.7bn, an increase).

Results increased significantly and came in above targets

Adjusted net income, Group share3 was up significantly (+13.6%2) thanks to a solid increase in net asset management revenue and an improved cost/income ratio3 (-2.4 pts vs. H1 20172). This performance confirms the Group’s ability to expand while keeping its costs under control.

- Net revenue stood at €1,347m, up +4.8%4, thanks to net management fees that increased in line with the growth in AuM and performance fees reflecting a strong performance by the funds.

- Operating expenses fell sharply (€677m or -4.6%4).

- As a result, the cost/income ratio3 of 50.5% (one of the lowest in the industry) improved by 2.4 points4.

Net income, Group share was €492m, up +13.63 compared with H1 20172. This increase was greater than the stated target of +7% per year5.